Let’s talk a bit about the dirty “R” word — rates.

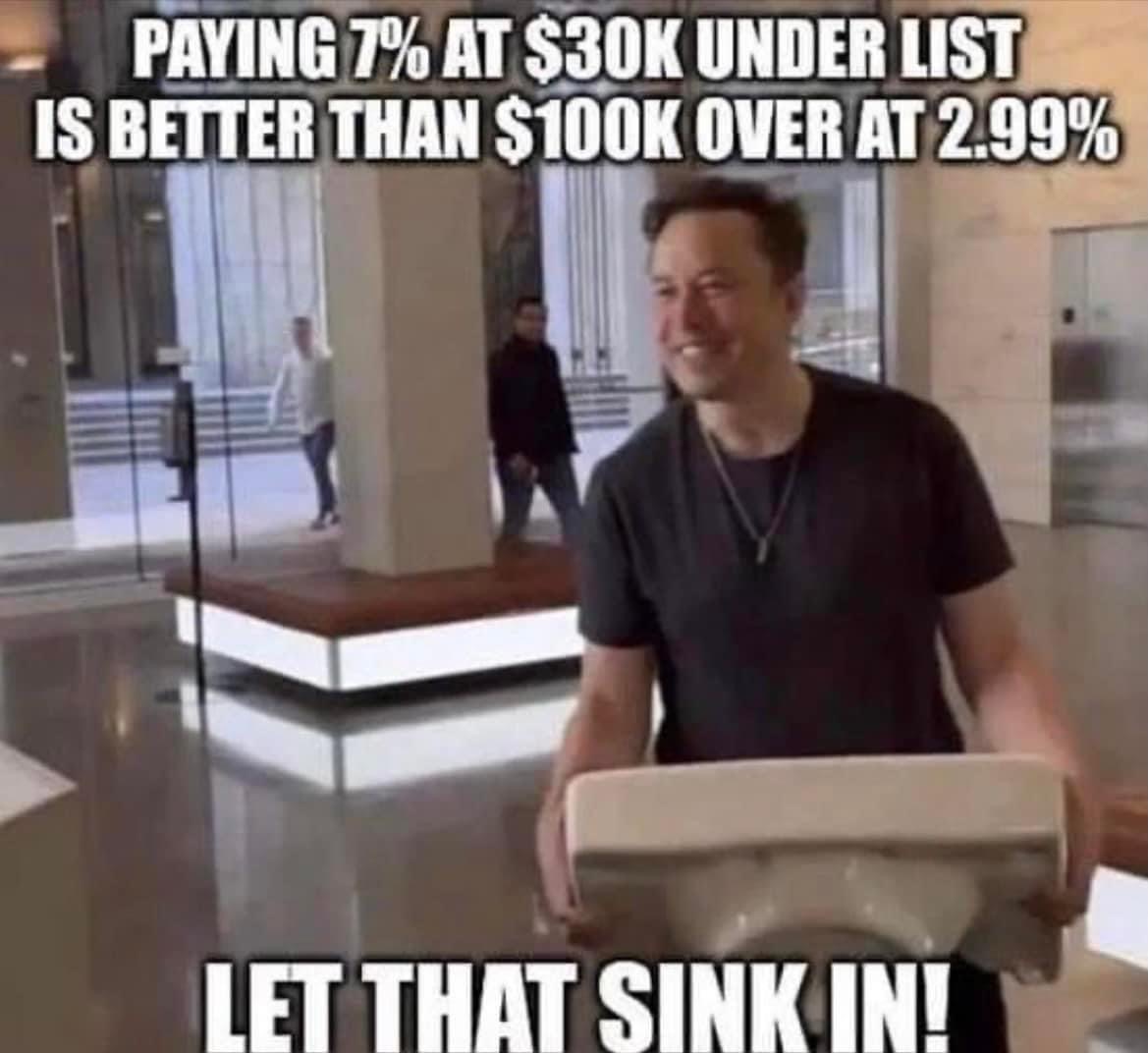

Mortgage interest rates have currently climbed to around 7%. Economists note that this is the highest level rates have been in 20 years, leading to the current real estate market slowdown of buying activity and purchase prices.

Let me interrupt here. Look back six to 12 months. Many buyers pulled back on searching for homes, because home prices had risen 20% to 25% in our area. The surplus of buyers and extremely low housing inventory caused extreme buyer competition, multiple offer situations, huge due diligence deposits ranging from $20,000 to $100,000, offer prices of 15% to 20% over list price, and virtually no repair negotiations by sellers who ultimately held a very strong upper hand. Buyers told me, “We want to wait until this crazy market slows down.”

Now, back to where we left off. The current mortgage interest rates have led to a market slowdown of buying activity and purchase prices. We’re here now at the point buyers were waiting for — less buyer competition, more inventory, better home prices, much lower due diligence fees, and sellers who are willing to negotiate list prices, repairs and provide concessions at closing to help buyers buy down their interest rate.

Despite this dramatically improved housing market, now many buyers are saying the reason they’re still holding out is the higher interest rates. They want to wait until interest rates decline. Do you have a guess what will happen when rates decline significantly? Buyers will flood the market, bringing back stiff competition, multiple offer situations, and ultimately drive home prices back up. It’s a vicious cycle!

Despite this dramatically improved housing market, now many buyers are saying the reason they’re still holding out is the higher interest rates. They want to wait until interest rates decline. Do you have a guess what will happen when rates decline significantly? Buyers will flood the market, bringing back stiff competition, multiple offer situations, and ultimately drive home prices back up. It’s a vicious cycle!

Look, if you’re a renter, you’re already paying 100% interest. There are tons of great homes listed for very reasonable prices right now. It’s time to get out of the cycle of renting and begin investing in your future and building equity. If you are a homeowner enjoying an already low interest rate and your current home is mostly functioning for your current needs, stay where you’re at. However, if your home no longer fits your needs, but you’re waiting for rates to drop, you might be waiting until 2024 and then, you may be facing higher purchase prices and more competition.

The bottom line is there are solutions to higher interest rates. Consider a temporary rate buydown, where builders or sellers provide cash at closing to buydown your rate. Learn about 3-2-1 and 2-1 buydowns (click here) from our preferred lender, OneTrust.

I’ll leave you with one more thought.

If you have questions or would like to discuss your current situation and possible solutions you may not have thought about, please give me a call. As your real estate advisor, I’m here to advise you and represent your interests. I am among the Top 25% of all Realtors in the nation and among the Top 10% of all Better Homes and Gardens Real Estate advisors in the nation.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link