Are you on the fence about whether you should buy a home now or wait? Consider the purchasing power buyers have today compared to 6-9 months ago.

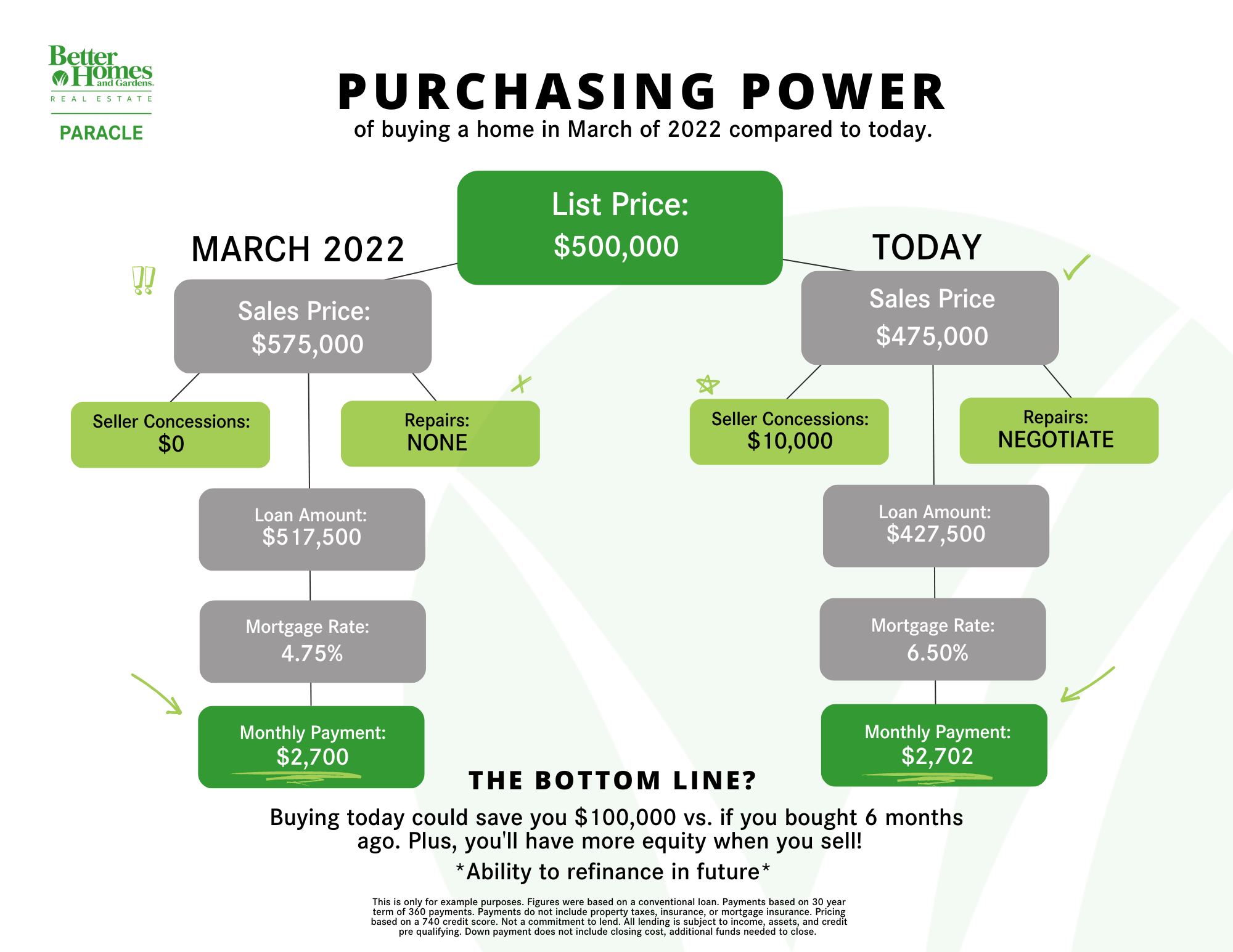

Let’s look at a List Price of $500,000 and compare the scenario of buying today vs. March 2022.

In March, homes were selling for 15% over asking price. Sellers were making no buyer concessions or repairs. A buyer making a 10% down payment ($57,500) with a mortgage rate of 4.75% would have a monthly payment of $2,700.

Today, that same home listed for $500,000 could sell for $475,000—or even less! Sellers are offering concessions to buyers and are negotiating repairs. A 10% down payment will be lower ($47,500), and with a mortgage rate of 6.50%, the monthly payment would be $2,702. Seller concessions can be used to temporarily buy down your interest rate, saving hundreds of dollars more each month, not included in this $2,702 figure! Don’t forget, you have the ability to refinance your loan in the future when interest rates drop again.

The bottom line is buying today could save you $100,000 vs. if you bought 6-9 months ago. Plus, you’ll have more equity when you sell! Talk about purchasing power!

Please call me if you have any questions or would like to discuss further. My job as an advisor is to provide all the information you need to make the best decision for you!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link